Announcement from SAMBAT Finance – 5-Month Grace Period for Customers Affected by COVID-19 Pandemic

Author

Digital Marketing

Posted On

6, April, 2020

SAMBAT Finance PLC, is cognizant of the financial difficulties faced by some customers particularly those involved in the tourism, garment, construction and transportation sectors during the COVID-19 outbreak. As a responsible lender, SAMBAT Finance PLC is sympathetic towards the plight of Cambodian people affected by the COVID-19 outbreak and in line with the Circular issued by the National Bank of Cambodia, we wish to offer our support to affected customers by offering a 5-month grace period on the servicing of their loans. During the 5-month grace period, our affected customers are only obligated to service their monthly interest and loan fee (if any) and the repayment of loan principal is suspended. Please note that the loan term of affected customers who accepted the 5-month grace period shall be extended for an additional 5 months.

Our Loan Restructuring Team will be contacting you soon. If you are an affected customer involved in the tourism, garment, construction and transportation sectors, please contact us immediately at 023/093 99 77 22.

Frequently Asked Questions (FAQ)

1. What do you mean by a 5-month grace period for loan repayment?

As a responsible lender, SAMBAT Finance is sympathetic towards the plight of customers affected by the COVID-19 outbreak. In line with the Circular issued by the National Bank of Cambodia, SAMBAT Finance wishes to offer its affected customers a 5-month grace period on the servicing of their loans. During the 5-month grace period, affected customers are only obligated to pay their monthly interest and loan fee (if applicable) as per their current loan repayment schedule. Any repayment of monthly principal sum shall be suspended during the 5-month grace period.

Examples:

-

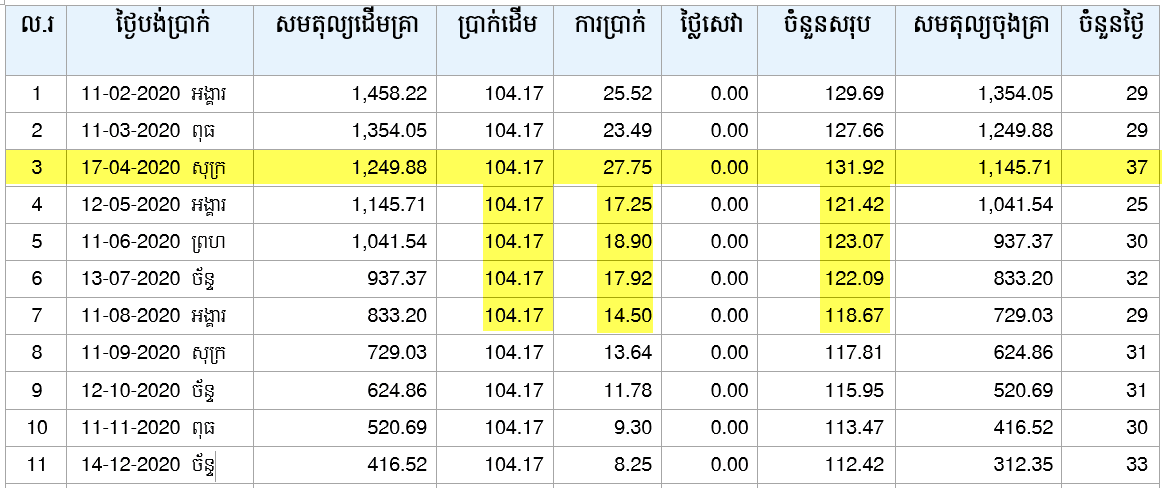

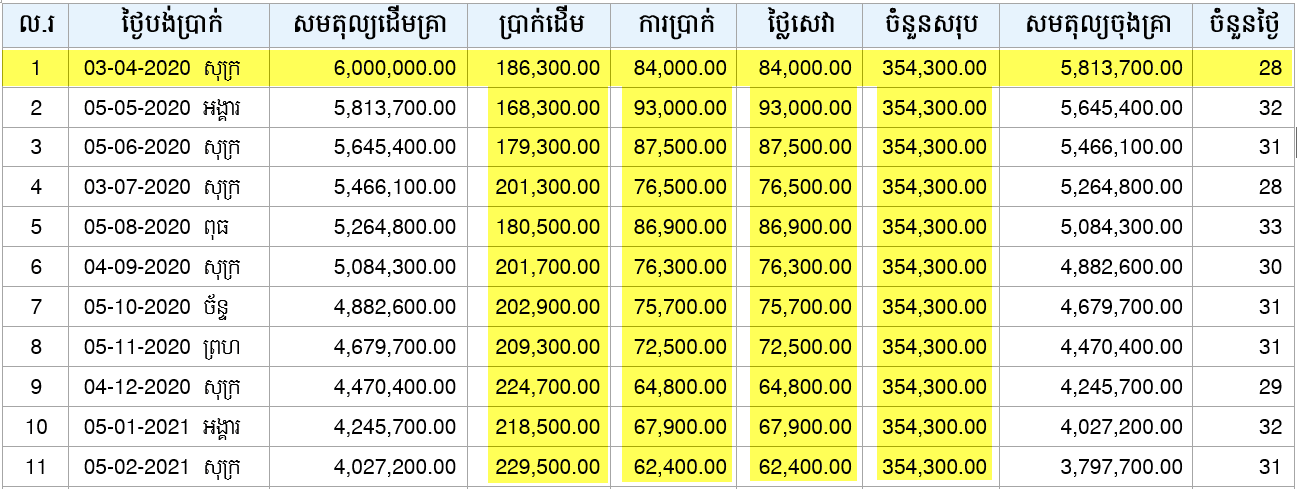

If your current loan is charged with interest only:

Current Monthly Loan Repayment Schedule

Monthly Loan Repayment during and after the 5-month grace period

-

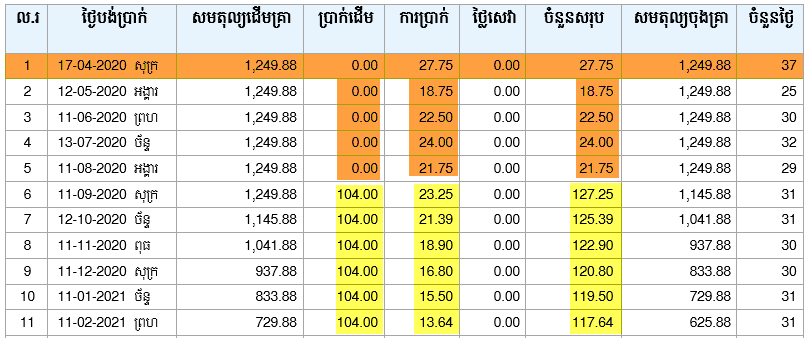

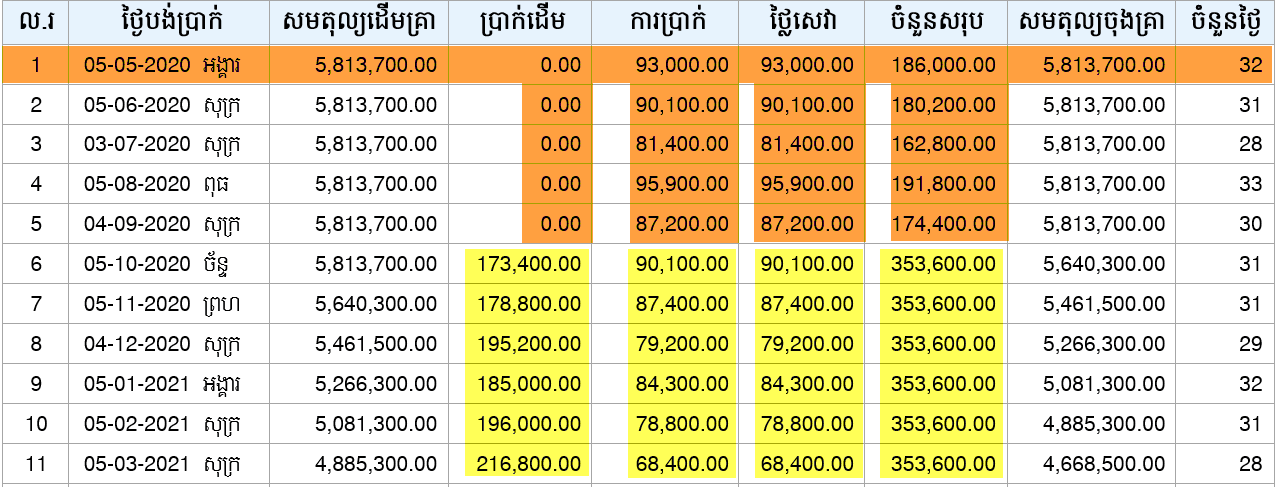

If your loan is charged with interest and loan fee:

Current Monthly Loan Repayment Schedule

Monthly Loan Repayment during and after the 5-month grace period

2. Am I eligible for the 5-month grace period during this COVID-19 outbreak?

Customers of SAMBAT Finance who are self-employed or employed by companies involved in the tourism, garment, construction and transportation sectors affected by COVID-19 outbreak. The 5-month grace period is automatically granted to customers identified by SAMBAT Finance as being affected by the COVID-19 outbreak.

Please note that Customers with installment payments past due for more than 90 days as of Apr 10, 2020 are not eligible for the 5-month grace period.

However, you are advised to contact us immediately if you wish to decline our offer of a 5-month grace period for loan repayment.

3. When is the effective date of the 5-month grace period?

The 5-month grace period is effective for loan repayment due date falling on or after 11 April 2020. For example, if your next loan repayment due date falls on or before 10 April, 2020, you are obligated to pay the full monthly repayment amount as per your current loan repayment schedule. The 5-month grace period shall start from your next loan repayment due dates falling in May 2020, June 2020, July 2020, August 2020 and September 2020.

Examples:

-

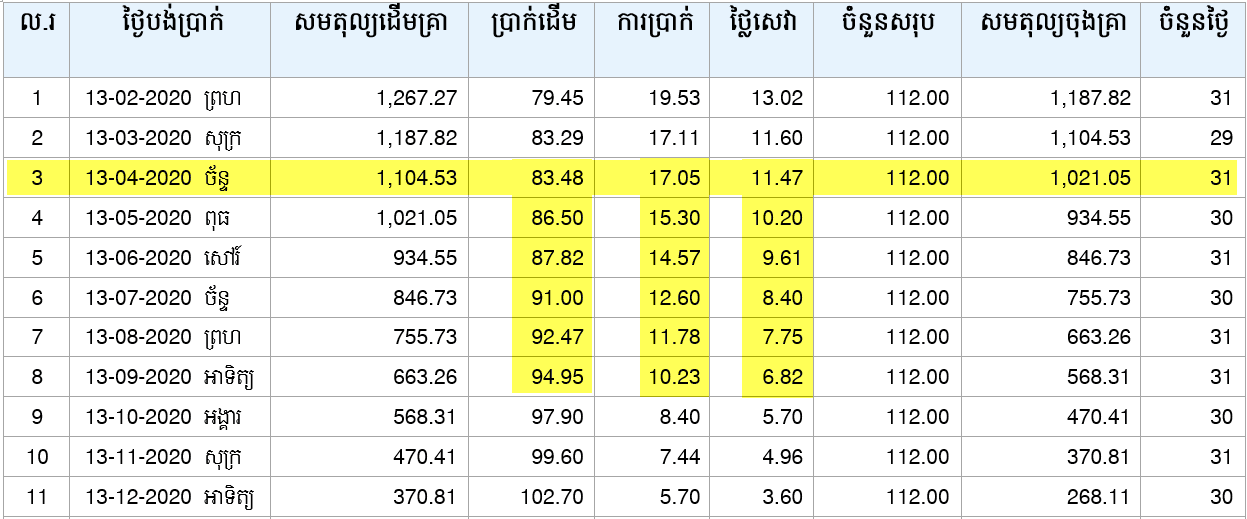

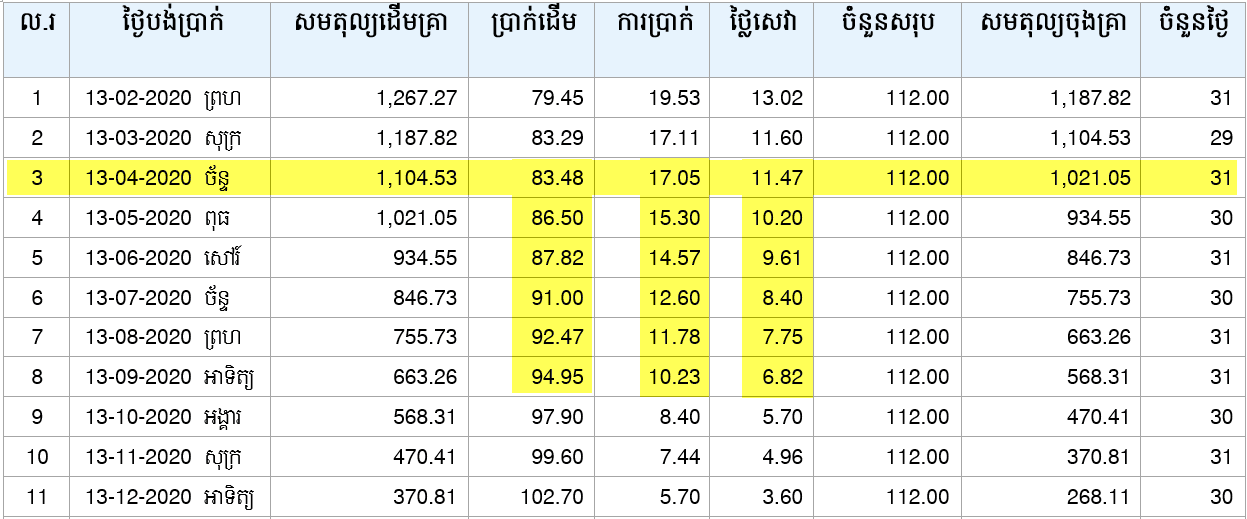

If your next loan repayment due date falls on or before 10 Apr 2020

Current Monthly Loan Repayment Schedule

Monthly Loan Repayment during and after the 5-month grace period

-

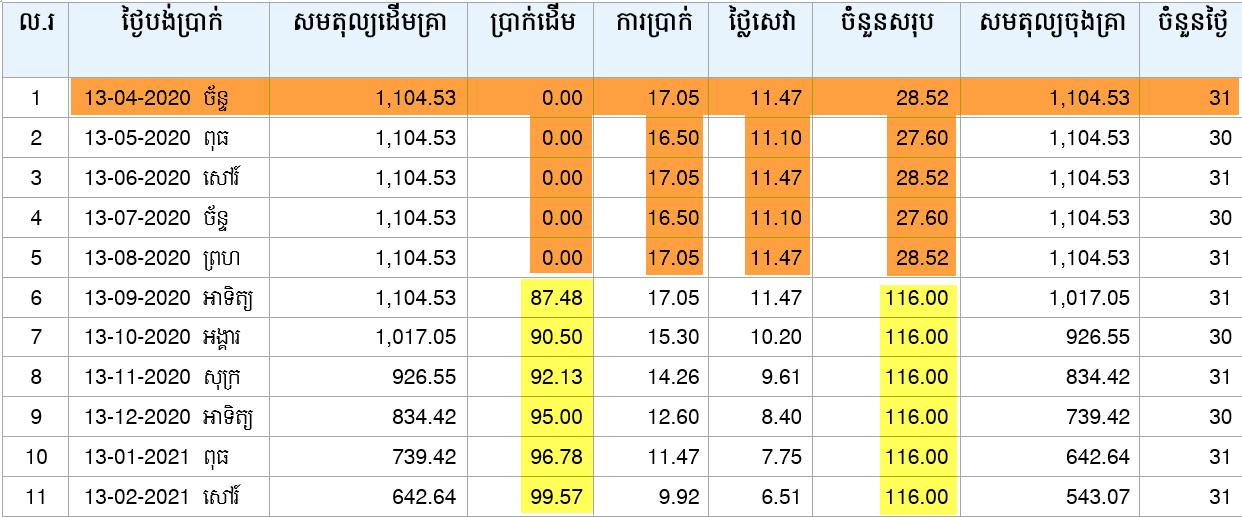

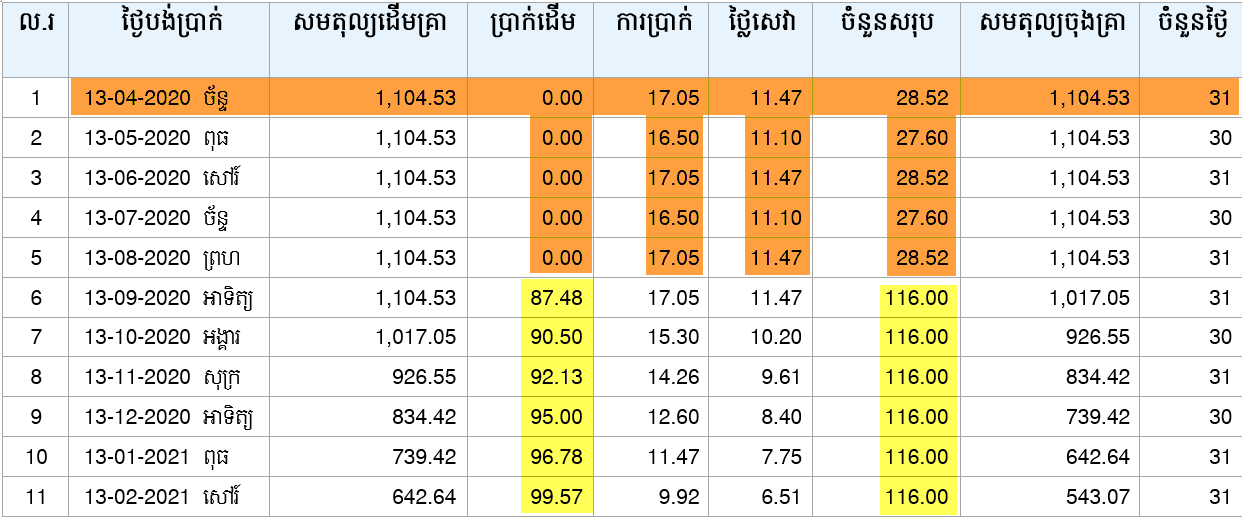

If your next loan repayment due date falls on or after 11 Apr 2020

Current Monthly Loan Repayment Schedule

Monthly Loan Repayment during and after the 5-month grace period

At the expiry of the 5-month grace period, you are obligated to pay the full monthly instalment amount as per the new loan repayment schedule.

4. Will I be imposed with any late payment penalty during the 5-month grace period?

You will not be imposed with any late payment penalty for the outstanding principal sum suspended during the 5-month grace period.However, you will be charged with late payment penalty if you fail to pay the monthly interest and loan fee (if applicable) on or before the stipulated loan repayment due date.

5. Is my loan term extended by 5 months?

YES. Your loan term will be extended by 5 months. Please refer to the new loan repayment schedule.

Example: Your existing repayment schedule will be matured on 15 Dec 2020. When your loan account is granted a 5-month grace period, your new repayment schedule will be matured on 15 May 2021.

6. Will I need to pay higher interest or loan fee if I accept the 5-month grace period?

The interest and loan fee shall be the same for the extended loan term.

7. Any increase to my monthly installment amount after the 5-month grace period?

Your monthly installment amount shall remain the same after the expiry of the 5-month grace period.

8. Will I receive a new loan repayment schedule?

YES. A new loan repayment schedule will be issued as your loan term is now extended by 5 months. Please contact us immediately if you do not receive the new loan repayment schedule.

Next Article

SAMBAT Finance Taps TurnKey Lender for Digitization